Expecting the Unexpected

In a volatile world, we aim to provide our clients with stability, competitive advantage and sustainable success.

Navigating New Forms of Volatility

Organizations must tackle volatility on two fronts: Managing current issues while strengthening strategies for future growth

In a volatile world, we aim to provide our clients with stability, competitive advantage and sustainable success.

Our modern world is unpredictable. Known threats, like climate change and pandemics, sit alongside emerging challenges such as data security, supply chain disruption, the rise of intangible assets and the widening health-wealth gap.

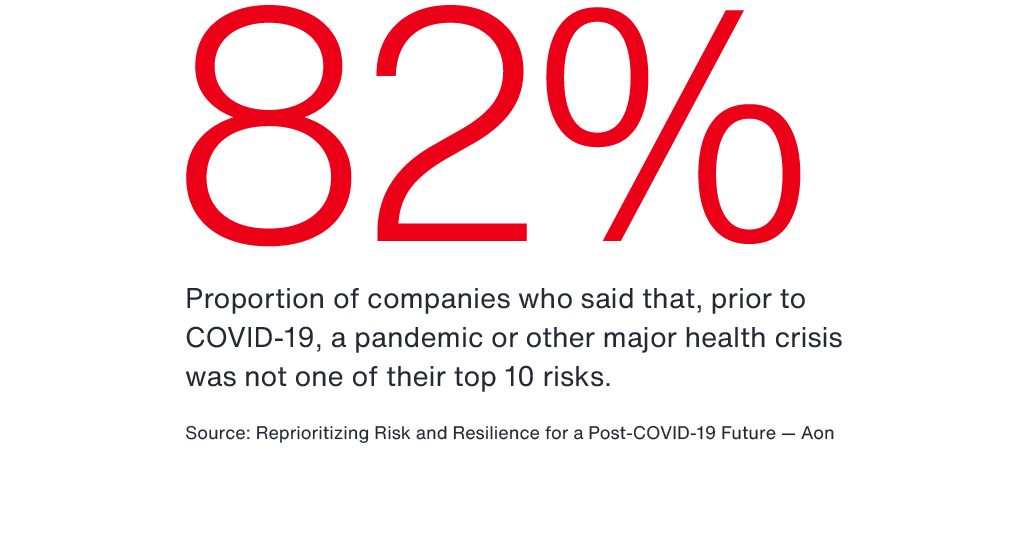

These new forms of volatility expose organizations to risks that impact their colleagues, their customers, their reputation and ultimately their bottom line. Risks that they often don’t see coming. This was illustrated by our recent research which showed that, prior to COVID-19, 82 percent of companies did not consider pandemics or other major health crises as one of their top 10 risks.

Aon is best placed to help clients navigate this new risk landscape, becoming a business partner that offers tailor-made services to help clients cope with the unexpected, protecting their assets and enabling them to continue growing their organizations.

Whether it’s protecting against diverse threats or responding to and recovering from their impact, we’re here to help clients make better decisions.

When the worst happens, we help our clients make the right decisions and get them back on their feet quickly. Should, for example, a ransomware attack hit your organization, encrypting your servers and demanding payment in exchange for a decryption key, our digital forensic incident response team can be quickly on hand to make sure every stakeholder — including insurers and banks — is kept up to date and that authorization to pay a ransom is given as quickly as possible. And even if funds are frozen due to the cyber attack, our colleagues know whom to call on to establish a line of credit to pay the ransom. Thanks to our world-class insight and expertise, should the worse happen, we are able to help your organization get back on its feet and operating smoothly again.

Whether emerging or traditional risks, Aon’s expertise and global understanding keep clients better informed and better advised so they can make the right decisions for their business. From responding to cyber threats and protecting complex supply chains to evaluating climate-related needs, we understand and advise on all of today’s threats. That way, in a volatile world, our clients can find stability, competitive advantage and sustainable success.